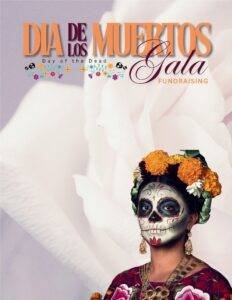

In Latin-American cultures, specific days are dedicated to remembering the departed. During this gala, we come together to share the beauty, grief, and celebration of lives lived, veils crossed, and souls honored.

Loading...

Loading...

In Latin-American cultures, specific days are dedicated to remembering the departed. During this gala, we come together to share the beauty, grief, and celebration of lives lived, veils crossed, and souls honored.

Embrace the winter holiday season with us as we celebrate the shared light and warmth across various traditions. Our show features dance, music and readings from Hanukkah, Christmas, Yule, Kwanzaa, Diwali, and Navidad Latina.

Embark on a fleeting glimpse into the cherished realms of three beloved children’s stories: The Three Little Pigs, Puss in Boots, and Little Red Riding Hood.

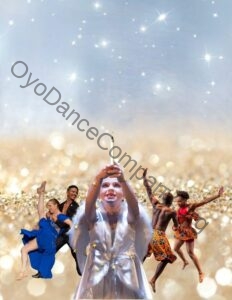

Oyo Dance Company performs Carmina Burana, a new choreography on Carl Orff’s cantata based on medieval poems, with live singers, musicians, and guest dancers.

Carmina Burana is a cantata by German composer Carl Orff. It is based on a collection of 13th century medieval poems. The poems were written in Latin, High German, and Old French between 1220 and 1250 by goliards, or young impoverished clergy who traveled Europe writing satirical songs, drinking songs, and romantic ballads.

The collection was discovered in 1803 in the library of an ancient Bavarian monastery, and given the title Carmina Burana, which is Latin for “Songs from Bavaria”. The poems offer a diverse view of medieval life, including religious verses, bawdy drinking songs, pastoral lyrics, and satires of church and government.

Orff was inspired by the poems and composed Carmina Burana between 1935 and 1936. He wrote the cantata for entertainment rather than religious purposes. The piece is subtitled “secular songs for singers and choruses to be sung together with instruments and magic images”. The music is dramatic and includes sections like “Primo Vere” (“In Springtime”), “Uf dem Anger” (“On the Green”), and “In Taberna” (“In the Tavern”). They explore themes of love, fate, and the contrast between medieval expectations and a more irreverent attitude towards life.

Featuring choreography by Alex Cornejo, music by members of the Worthington Chamber Orchestra, guest Dancers from El Salvador, and live Opera Singers!